Please fill out this form to gain a more accurate understanding of your customers’ financial standing.

Verify your customer’s income and employment instantly

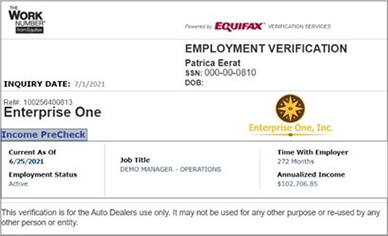

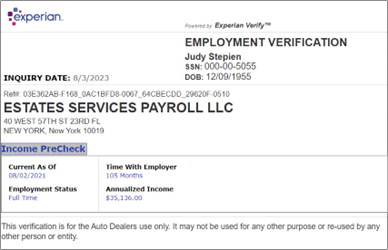

- 700Credit’s Income & Employment Verification platform Income Precheck, combines the power of Experian’s Verify™ product with The Work Number® from Equifax (learn more below).

- The platform delivers more insight into your customer’s income and employment position while greatly improving our hit rates to over 60%.

Loan application misrepresentations — such as employment fabrication, income manipulation – are a growing source of source for dealerships today. In a recent survey of over 700 dealerships, 89% saw an increase in loan application fraud in the past 12 months with over 33% reporting that one in every 100 applications at their dealership was fraudulent. And 53% of those surveyed stated that income and employment manipulation was their #1 concern today.

Income Precheck helps dealers gain a more accurate understanding of a customer’s financial standing, providing information including:

- Employer name

- Employment status and job title

- Annualized income calculation

Now available with permissioned payroll account access

Through the Experian Verify™, dealership customers can access their payroll accounts and share information directly from their employers’ payroll service so you can maximize coverage and verify income and employment for customers in real time.

This enhancement introduces Experian’s automated income and employment verification waterfall, which blends the power of instant and permissioned verification into one seamless experience for you and your customers.

This new enhancement:

- Increases hit rates by expanding coverage to employers not currently contributing to the instant employer payroll network.

- Expands reach by helping verify a broad spectrum of consumers, including contractors, gig workers, government employees, etc.

- Reduces customer abandonment by helping dealerships keep customers engaged in their digital channel when instant verification is not available.

If you are ready to offer a better auto buying experience that reduces steps and keeps the customer in the store, then Income Precheck is for you. Please fill out the form above.

Why partner with 700Credit?

Easiest, most automated credit and compliance workflow in the industry

Access to all three bureaus

One-stop to monitor and manage your compliance obligations

24/7/365 Support Desk