To address a synthetic identity fraud challenge that extends beyond specific credit behavior and relationships, we offer synthetic identity detection rules. These specialized rules consist of 30 conditions that evaluate a broad selection of consumer behaviors. When they occur in specific combinations, these behaviors indicate synthetic identity fraud. Evaluating a consumer’s credit behavior enables synthetic identity detection rules to decipher actions consistent with criminals versus the behavior displayed by consumers who are new to credit. Reducing the incidence of inaccurately associating a real identity with a fictitious one provides a better customer experience.

Synthetic Identity Protection

Keeping your dealership safe from even the most sophisticated types of fraud

Advancements in identity authentication practices compel criminals and their networks to constantly adjust their tactics to exploit opportunities for which there are limited solutions. Synthetic identity fraud is a recent example of this type of criminal creativity.

Please fill out the form to protect your store from Identity Fraud. A 700Credit Representative will be in contact you shortly.

The Synthetic Identity Challenge

When it comes to synthetic identity fraud, knowing there is a problem is half the battle. Unfortunately, many organizations are unaware of the presence of synthetic identity fraud in their customer portfolio. Detecting it is challenging because fraudsters take the time to develop their synthetic identity to mirror a real one. Our Synthetic ID Solution is built to combat synthetic fraud using a breadth of data and a suite of analytical fraud solutions to prevent criminals from continuing to hide behind their false identities.

How the 700Credit Synthetic Identity Solution Keeps You Safe

Finds Previously Undetectable Risks

Synthetic Identity protection tool helps identify the nuances that have made synthetic ID fraud such a damaging problem to the industry.

Evaluate Consumer Behavior Consistent with Synthetic ID Fraud

Through proprietary logic and unique combinations of available data, our solution can detect the behaviors that are consistent with those of a synthetically created identity.

Uncover Connections to Real Identities

A key component of Synthetic ID fraud is the connection to a legitimate account that the fraudster uses to build their identity. 700Credit’s ID solution helps connect the dots to find accounts that may be associated with a synthetic ID fraudster.

See How Customers Score

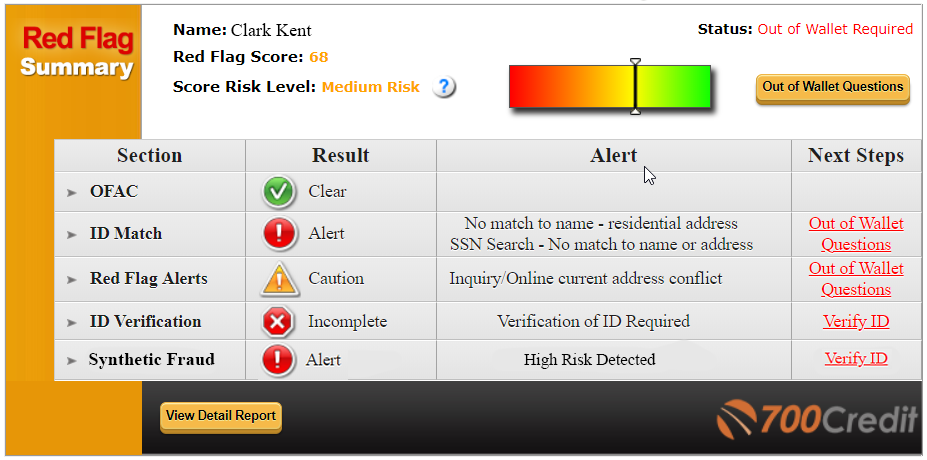

The Synthetic ID score is automatically added to the Identity Verification Table which makes detection and remedial action easy with “Next Steps” provided, should you encounter a suspected synthetic ID in your dealership.

High Risk Fraud Score

Using proprietary logic and unique combinations of available data, the high-risk fraud score looks at a consumer’s credit behavior and credit relationships over time to uncover previously undetectable risk. Our model complies with the Fair Credit Reporting Act (FCRA) and returns a risk score with score factors to help determine if a new customer application is likely associated with a synthetic identity. The high-risk fraud score has been very effective in finding those synthetic identities that are established and approaching the maturity level necessary to perpetrate fraud. Additionally, the score can detect those identities that are products of synthetic identity farms.