Insight Score® for Auto

Data you need to extend offers to more applicants, while getting a deeper view of potential risk.

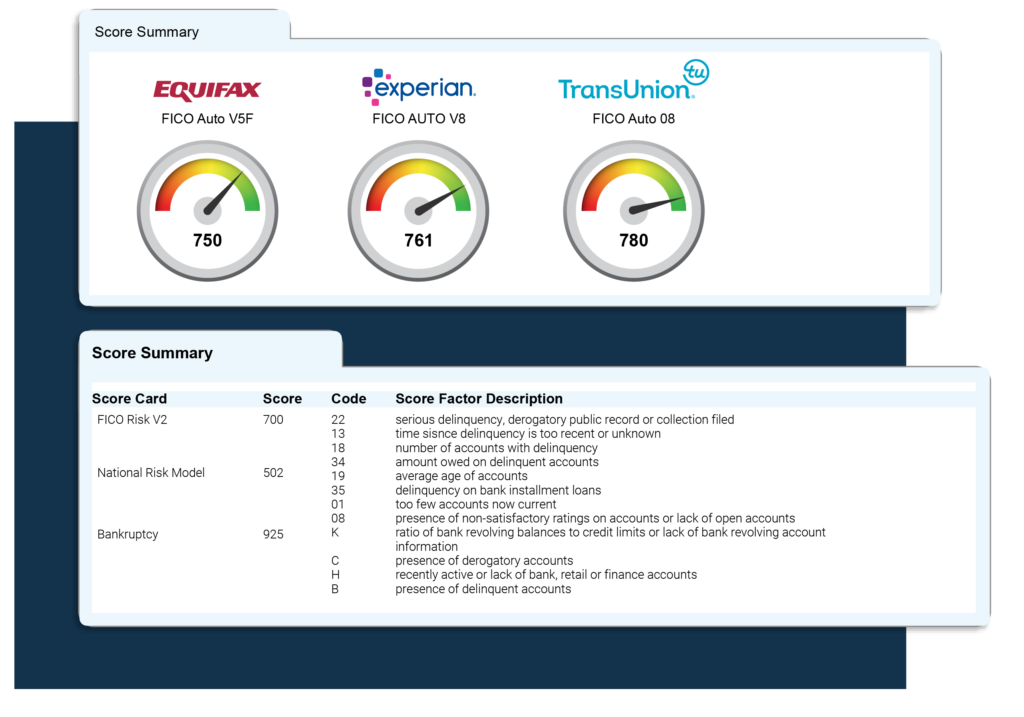

Designed to help expand access to credit for consumers seeking to finance a vehicle, this industry-specific credit risk score combines proprietary credit data from Equifax with alternative data. Automotive lenders use this score today for American shoppers with “thin” to no credit files to increase their capabilities in extending loan offers to these consumers.

This credit score can elevate consumers from non-scorable or subprime offers to near-prime or prime ones, helping them secure an auto loan with your dealership.

Please fill out the form to start helping customers secure an auto loan. A 700Credit representative will contact you.

How Does Insight Score® Work?

The Insight Score® employs NeuroDecision® Technology to apply models designed exclusively for the auto industry and helps predict the likelihood of a consumer becoming 90 days+ past due within 24 months of an auto loan being opened.

-

Uncover new prospects among no file, thin file, and unbanked customers.

-

Expand consumer access to credit opportunities by up to 16%.

-

Evaluate new auto loan applicants with greater confidence and less risk.

-

Adjust credit levels among current customers based on a more complete view of the payment histories and behaviors.

Insight Score® Key Benefits

Expand Your Auto

Prospect Pool

Users saw up to a 16% increase, compared to traditional generic risk scores.

Make Confident

Lending Decisions

Increase approvals by up to 67%, compared to a generic risk score.

Elevate Your Consumer’s Experience

Start offering more competitive, personalized offers and improved decisioning and service.

By leveraging alternative data and the proprietary NeuroDecision® Technology, the Insight Score® performs better than the leading benchmark scores across targeted marketing segments. Designed specifically for the auto industry, the Insight Score provides you the data you need to extend more offers, while also giving you a deeper view of potential risks.