Thank you for your interest in 700Credit. Please enter your contact information below.

Credit and Compliance Solutions

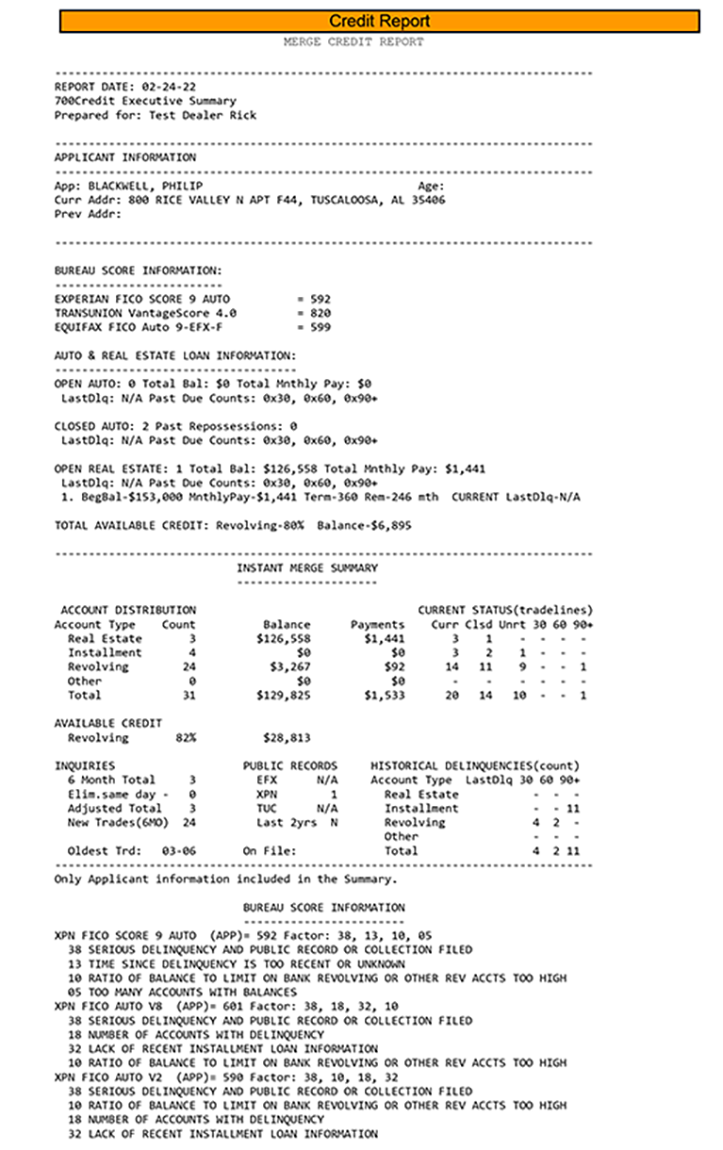

700Credit is the largest provider of credit, compliance, and soft-pull solutions to automotive, RV, Powersports, and Marine dealers across the country and the leading authorized reseller of credit reports from Equifax, Experian, and TransUnion.

700Credit is seamlessly integrated with AppOne so dealers can seamlessly pull credit reports and receive the following information with every report pulled:

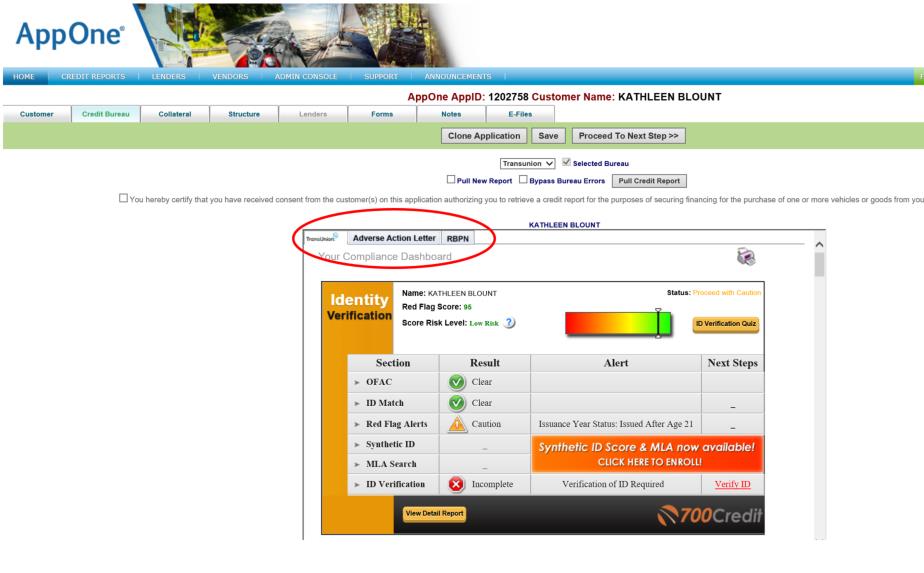

- Identity Verification/Red Flag platform which provides a vital service by flagging application information that on the surface may seem true, but in reality, is questionable. These warning messages focus on high-risk applicants, social security numbers, and addresses.

- Tabs for each credit report pulled, and Risk Based Pricing and Adverse Action notices (if applicable)

- Link to the Compliance Dashboard which enables dealers to stay on top of and manage credit reporting and compliance from one single view.

- All 700Credit clients receive their choice of credit report format and score, including the format you are utilizing TODAY in your dealership.

Benefits of 700Credit Integration

- Eliminating the need to toggle between systems

- Access to the industry’s most automated workflow for all your credit & compliance needs

- A more efficient sales process

- Manage credit reporting and compliance from one system

- Our report delivery times are among the fastest and most reliable in the industry because we utilize a Tier One hosting provider

- 700Credit’s compliance solution is automated and guaranteed to keep dealers on top of today’s compliance obligations.

- Every install comes with a quick start guide and implementation support to walk dealers through how things work inside AppOne.

Compliance Overview

700Credit offers an array of products and services in a customized package for your dealership, all of which work to automate your compliance practices, keeping your dealership ready at all times for future audits.

Adverse Action & Risk-Based Pricing Notices

With every credit report pulled, there will be tabs at the top of the screen (circled below) for each credit bureau purchased, as well as the Risk-based pricing notices and Adverse Action Letters. If you click on any of the tabs, the appropriate document will be presented.

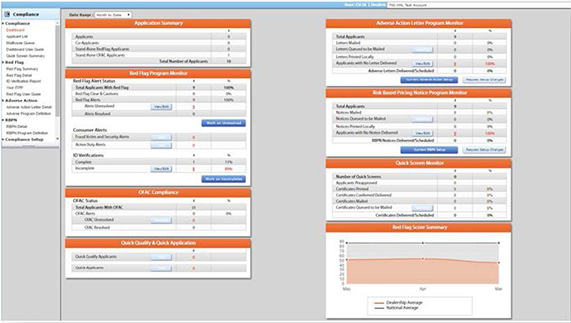

Compliance Dashboard

Our Compliance Dashboard is a complete monitoring solution, which is unique in the industry and helps you stay on top of and manage credit reporting and compliance from one single view.

Our compliance dashboard has everything you need to monitor your requirements in one place and quickly align yourself to be compliant. Sections on the dashboard include:

- Summary of credit applicants

- Red Flag Monitor

- OFAC Compliance

- QuickQualify, QuickApplication, QuickScreen monitors (if purchased)

- Adverse Action program

- Risk based pricing notices

- Red Flag Summary

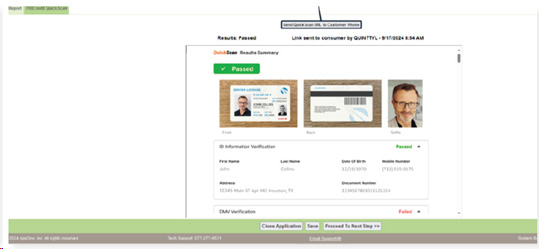

Driver’s License Authentication – QuickScan Integration

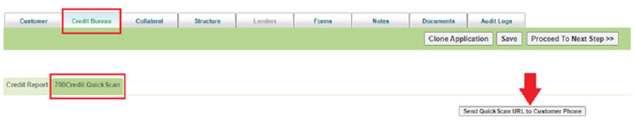

AppOne has integrated the 700Credit Driver’s License Authentication Platform – QuickScan – into their platform.

QuickScan from 700Credit is a powerful mobile document scanner that provides dealerships real-time confirmation of the legitimacy of a customer’s driver’s license and identity. It can be used with both in-store and remote

Why partner with 700Credit?

Easiest, most automated credit and compliance workflow in the industry

Access to all three bureaus

One-stop to monitor and manage your compliance obligations

24/7/365 Support Desk