700Credit is the largest provider of Credit Reports and Soft Pull solutions to over 23,000 Automotive, RV, Powersports, and Marine dealers across the country and the leading authorized reseller of Credit Reports from Equifax, Experian, and TransUnion.

Thank you for your interest in 700Credit. Please fill out the form and someone will be in contact with you shortly.

Integration Overview

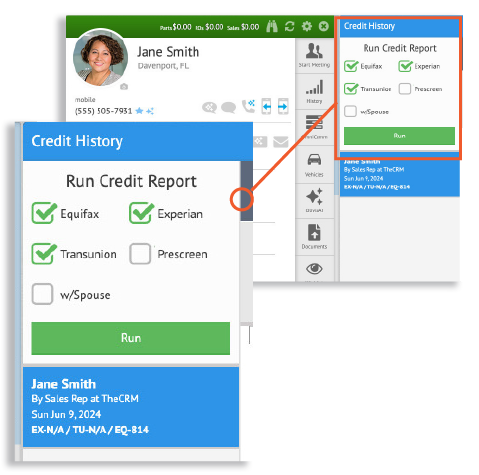

TheCRM has integrated the 700Credit credit reports, compliance and soft pull prescreen solutions into their platform.

Credit Report Solutions

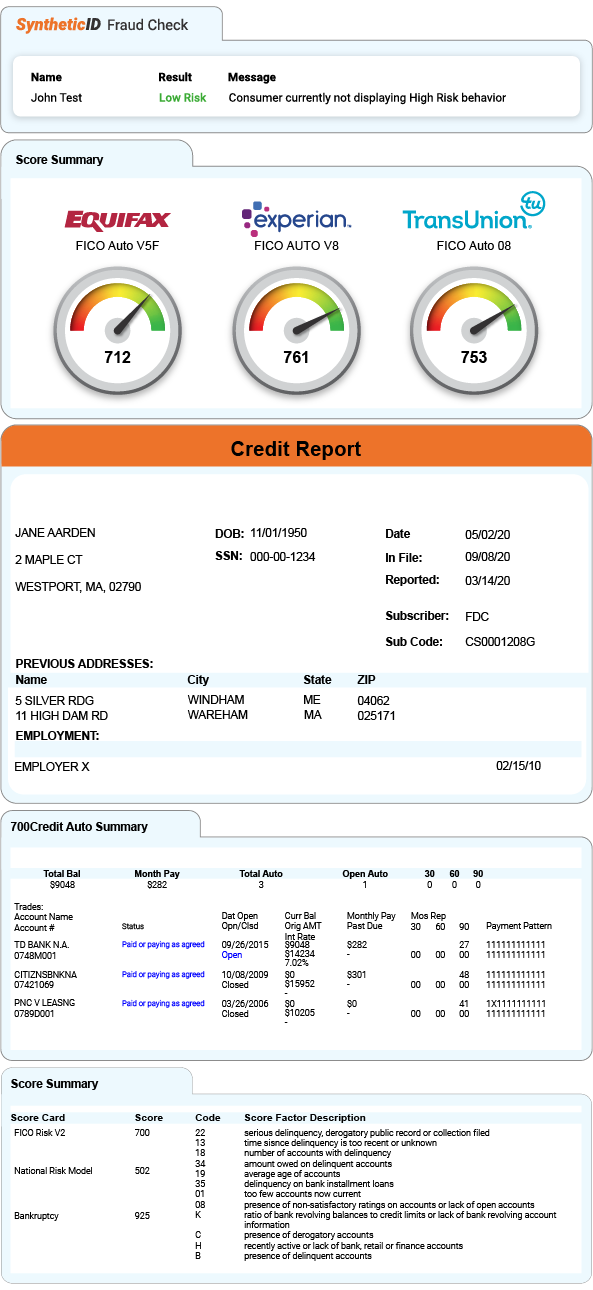

700Credit is seamlessly integrated with the TheCRM so dealers can pull credit reports and receive the following information with every report pulled:

- All dealers receive their choice of credit report format and score.

- Identity Verification/Red Flag platform which provides a vital service by flagging application information that on the surface may seem true, but in reality, is questionable. These warning messages focus on high-risk applicants, social security numbers, and addresses.

- Tabs for each credit report pulled, and Risk Based Pricing and Adverse Action notices (if applicable)

- Link to the Compliance Dashboard which enables dealers to stay on top of and manage credit reporting and compliance from one single view.

- Multi-bureau summary

With the integration of 700Credit and TheCRM, dealers can make smarter and more immediate credit decisions, benefiting from a seamless workflow facilitating a speedier sales process.

Prescreen Overview

700Credit prescreen data expands the number of customers for whom quotes can be provided in the service lane by filling in the gaps on customers who did not purchase the vehicle at the store.

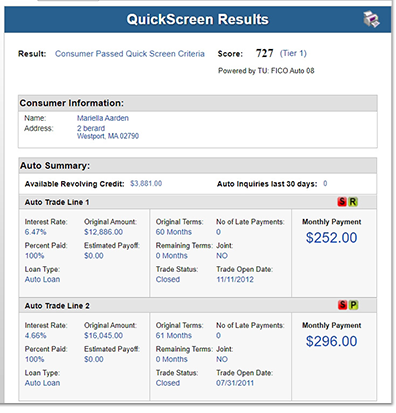

QuickScreen is a soft pull solution that does not require a customer’s SSN or DOB, and does not affect their credit score. QuickScreen integration with XtreamService provides the following insights into the customer’s credit profile:

- FICO Score

- Available Revolving Credit

- Auto Inquiries last 30 days

- Summary of Auto Trade Lines Including:

- Current Monthly Payment

- Current Auto Loan Interest Rate

- Original Loan Term

- # of Late Payments

- Remaining Balance, Term and Estimated Payoff

Benefits of Prescreen Integration:

- Integrating a prescreen solution in the service lane provides visibility into customers’ equity position and FICO score without posting a hard inquiry on their credit file.

- Expand your SERVICE LANE sales opportunities by filling in the gaps on customers who did not purchase the vehicle at your store resulting in net new customers.

- Prescreen data provides amount owed and the customer’s FICO score, enabling equity and payment estimates to be calculated accurately so a valid offer can be made.

Why partner with 700Credit?

Easiest, most automated credit and compliance workflow in the industry

Access to all three bureaus

One-stop to monitor and manage your compliance obligations

24/7/365 Support Desk