Thank you for your interest in 700Credit. Please fill out the form and someone will be in contact with you shortly.

Integration Overview

TradePending has integrated 700Credit’s prequalification soft pull product into their “Approve” platform. The alliance integrates our prequalification platform seamlessly into the online shopping process enabling your dealership to see their FICO® score and full credit report at the top of the sales funnel without requiring their SSN or DoB.

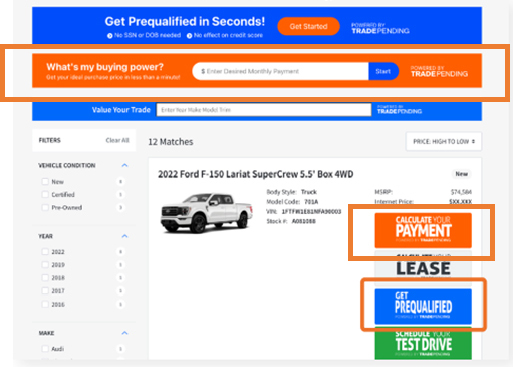

If a TradePending dealer has the “Payments” platform and also purchases the “Approve” platform, the 700Credit prequalification process will also be available in the “What’s my buying power” and “Calculate my payment” options circled below.

Introduction to Prequalification

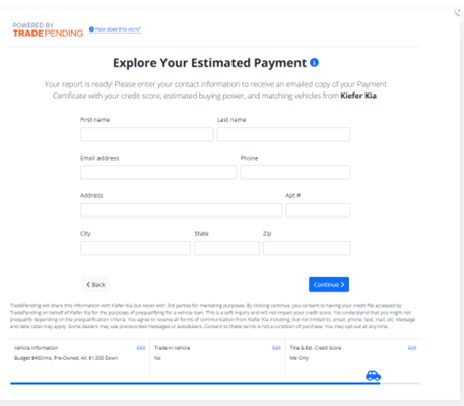

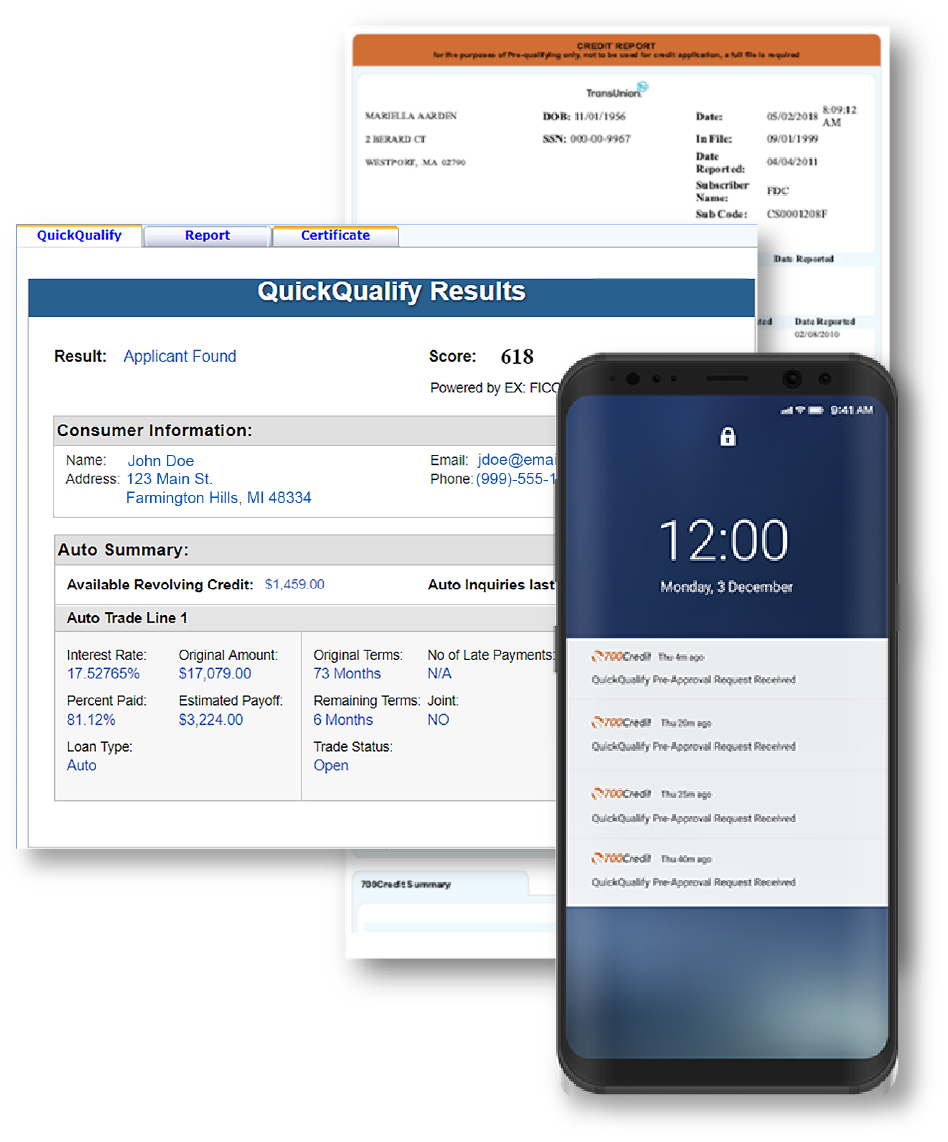

The 700Credit prequalification platform does not require a consumer’s SSN or DOB and has no effect on their credit score. Presented with a simple lead form, consumers can quickly get prequalified for a vehicle and receive an accurate payment quote while going through the TradePending Payments and Approve platforms. Dealers receive a FICO score and full credit file making it easy to estimate payments and understand what the consumer is qualified for before the first phone call. Our QuickMobile app makes it easy and convenient for dealers to receive and respond to customers who have run through the prequalification process.

Benefits of Prequalification in Digital Retailing

The integration of the 700Credit prequalification platform into the online retailing process provides benefits to both dealers and consumers:

- Soft pulls give you the same visibility into your shopper’s credit history for a fraction of the cost.

- With the consumer’s actual FICO® score incorporated into the rate calculation, more accurate payment quotes are provided to consumers through the digital retailing tool.

- Dealers receive a full credit report including FICO® Score, amount owed on vehicle for an accurate equity calculation, months remaining on loan or lease and current monthly payment.

- Consumers see their current FICO® score range and get pre-approved for a vehicle loan.

- Consumers that are prequalified early in the sales process are PROVEN to generate higher lead conversion rate than those that were not.

To learn more or to get started today, fill out the lead form above and a representative will contact you shortly.

Why partner with 700Credit?

Easiest, most automated credit and compliance workflow in the industry

Access to all three bureaus

One-stop to monitor and manage your compliance obligations

24/7/365 Support Desk