Prescreen - QuickScreen

Eliminate the guesswork when working a deal

QuickScreen is a dealer-initiated soft-pull solution that does not require a customer’s SSN or DOB and does not affect their credit score. QuickScreen can be integrated with many applications at your store, giving you visibility into your customer’s credit profile before you work a deal, so you can work the right deal, right away.

Please fill out the form and a 700Credit representative will contact you.

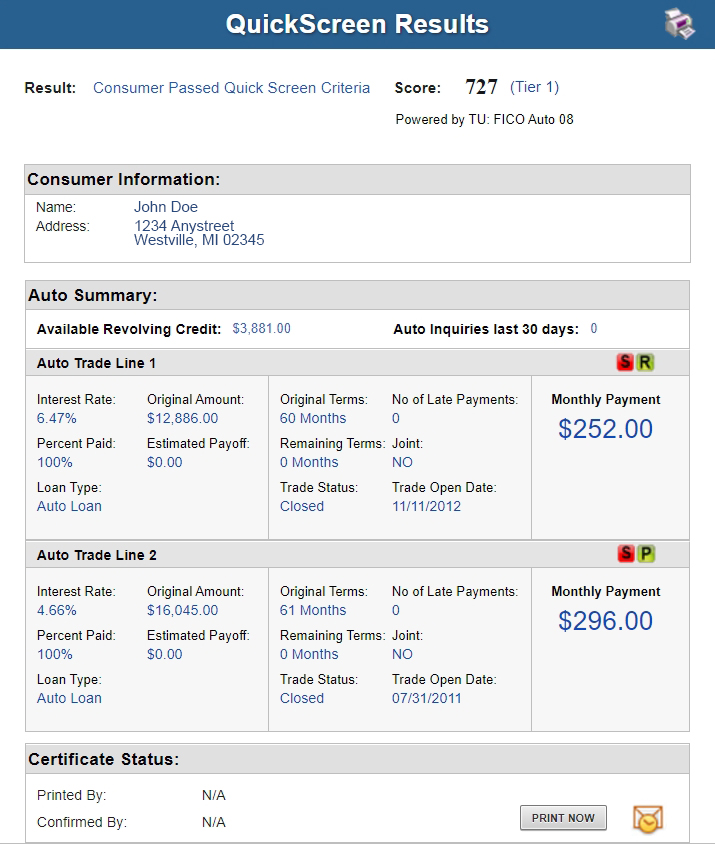

When you run a QuickScreen on a customer, you receive the following data:

- FICO Score

- Available Revolving Credit

- Auto Inquiries last 30 days

- Summary of Auto Trade Lines including:

- Current Monthly Payments

- Current Auto Loan Interest Rates

- Remaining Balance/Payoff Payment History

- Months Remaining on Auto Loans

What our Customers are Saying

Four Key Benefits of QuickScreen

Provides visibility into customers’ FICO Score and equity position without posting a hard inquiry on their credit file

Fill in the gaps with prescreen data for service lane customers who did not purchase the vehicle at your store, resulting in NET NEW customers

Customers know they are qualified before they get to the finance office, preventing a potentially uncomfortable situation or loss of interest

Shortens sales cycles by aligning the consumer with a car they can afford – and be approved for earlier in the sales process

QuickScreen Batch

QuickScreen Batch is a platform that enables dealers to manually upload a customer list to their 700Dealer.com portal and run batch prescreens processed overnight with results available the following morning. Running prescreens in a batch process allows for a lower price point. QuickScreen Batch is an add-on solution for customers currently using the QuickScreen, prescreen platform.

QuickScreen Batch supports all three bureaus.

QuickScreen Batch can be used:

- In the service lane to prescreen customers before their appointment to identify vehicles ready for a trade, facing a high service bill or to lower the current interest rate

- In the BDC to run a batch prescreen on inbound leads

- On your sales database to remarket to customers who didn’t purchase, or haven’t purchased for a while

- On purchased sales leads before you reach out to the prospect

Integrations

Our Prequalification solution is easily integrated into several types of consumer-facing platforms where customers can quickly be preapproved, without leaving the dealership workflow. Some common integrations today include:

Digital Retailing

Providing complete visibility to a consumer’s FICO Score to ensure accurate payment quotes

Dealership Website

To encourage consumers to get pre-qualified before walking in to the store

Email Marketing

Include a prequalification link in your email campaigns to drive engagement

Live Chat

Allowing agents to push a link during a chat conversation to engage the consumer

In-Store Applications

Tablet and kiosk apps encourage consumer prequalification right from your sales floor

OpportunityAlerts

In addition to the credit data that is provided with QuickScreen, OpportunityAlerts are color-coded graphic icons that alert the dealer to potential opportunities based on specific data points in the customer credit summary. Triggers are set in the dealer’s QuickScreen implementation, and a proprietary algorithm reads data from the QuickScreen results and presents the appropriate alert/color.

Alerts are available for the following data points:

- Credit Score (S)

- Interest Rate (R)

- Inquiries (I)

- Loan Term (L)

- Monthly Payment (M)

- Paid Percentage

The BENEFITS of Opportunity Alerts include:

- Quickly identifies opportunities that exist in the QuickScreen results.

- Makes the QuickScreen product easier to read, easier to use.

- Helps the dealer to focus on the data that will help them work – and close – the best deal.